Subscriptions for Invego bonds with an annual interest rate of 11% begin

On May 12, real estate developer Invego’s first public bond offering begins, giving Baltic investors the opportunity to purchase the company’s bonds with an 11% fixed annual interest rate.

The bonds will be issued by Invego Latvia OÜ, an Estonian company of the Invego group. It is planned to issue up to 4,000 secured bonds, each with a nominal value of 1,000 euros. If the demand is higher, the issue volume may be increased. The bonds have a 4-year maturity, a fixed annual interest rate of 11%, and interest is paid quarterly.

The bonds are secured by a commercial pledge on 100% of the capital shares of SIA Invego Latvia. After the issue, the bonds are planned to be listed on the Nasdaq Baltic First North alternative market.

Baltic private and institutional investors can submit subscription orders at all banks offering investment services in the Baltic States from May 12th 10:00 AM to 10:00 PM. May at 15.30.

Use of funds raised in bond issuance

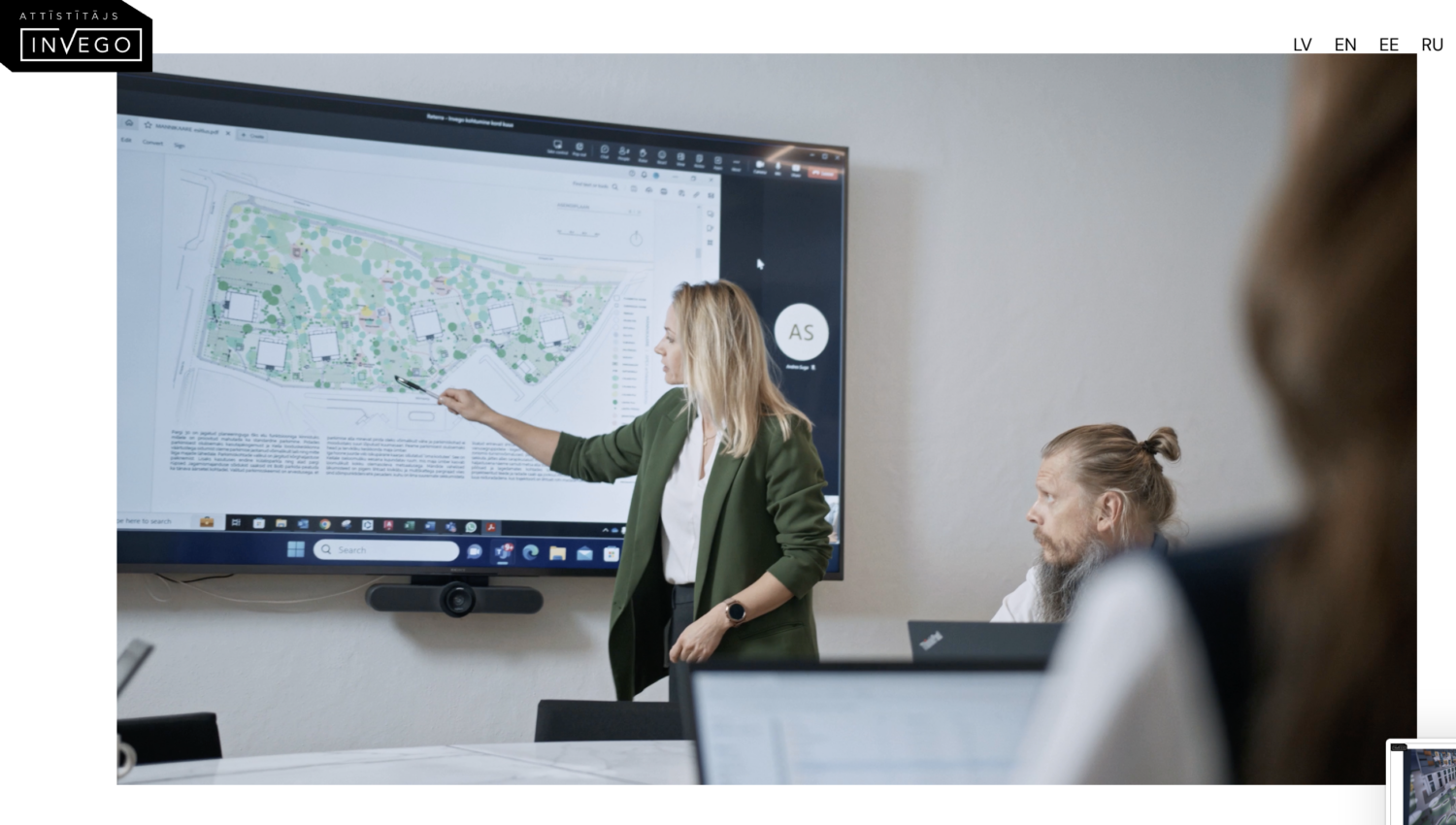

Invego, which operates in three countries with more than 30 development projects, plans to invest the funds raised in the issue in residential development projects in Latvia. The raised capital will strengthen the company’s position in the Latvian market, where 12 development projects are currently being implemented – six of which are already in the sales phase, and another six are in active development.

Invego plans to use the funds raised through the bond issue to finance development activities, ensuring the successful implementation of the construction phases and the necessary co-financing in addition to bank loans and financing from existing investors. Investments include planning, design, marketing and construction financing with equity.

“Over the past decade, Invego has proven its ability to successfully create high-quality residential buildings and commercial spaces that grow in value over time. Today is the right time to support the company’s expansion into the Latvian market, where we see significant growth potential,” says Kristjan-Thor Vähi, founder and CEO of Invego. “Our experience in Riga so far shows that real estate is currently more affordable here than in Tallinn, demand is higher, and customers’ desire to improve their quality of life is growing rapidly. This year, Invego has already sold more homes in Latvia than in Estonia.”

Latvian market potential

Invego focuses on the development of comprehensive new urban projects in Riga and its surroundings, where more than 3,000 housing units with a total area of 250,000 square meters are currently under development. The projects include both apartment buildings and townhouses, offering quality residential real estate to various market segments.

“We are already one of the largest developers in the Latvian market, and our goal is to reach 300 million euros in sales by 2030,” explains Kristjans-Tūrs Vahi. “If you compare Riga and Tallinn, planning procedures in Riga are much faster, which ensures more efficient use of capital.”

The Latvian market is strategically important for Invego, as real estate prices in Riga are on average more affordable than in Tallinn, while construction costs are similar. In addition, more than 90% of Riga residents still live in Soviet-era apartment blocks, while the number of loans issued per capita in Latvia is more than half that in Estonia, indicating obvious growth potential.

Subscription to the offer and investments

Investors can purchase bonds through Baltic banks that offer securities transaction services. An active securities account is required to subscribe for the bonds. The minimum investment amount is EUR 1,000. The results of the offering will be announced on May 26, while the first day of bond trading on the stock exchange is scheduled for May 30 or later. The bonds have a maturity of four years from the date of their registration — tentatively on May 29, 2029.

Read more here